Fast. Digital. Financing.

Start your business growth journey with ethical financing designed for SMEs. Our digital platform provides fast, transparent funding aligned with ethical principles.

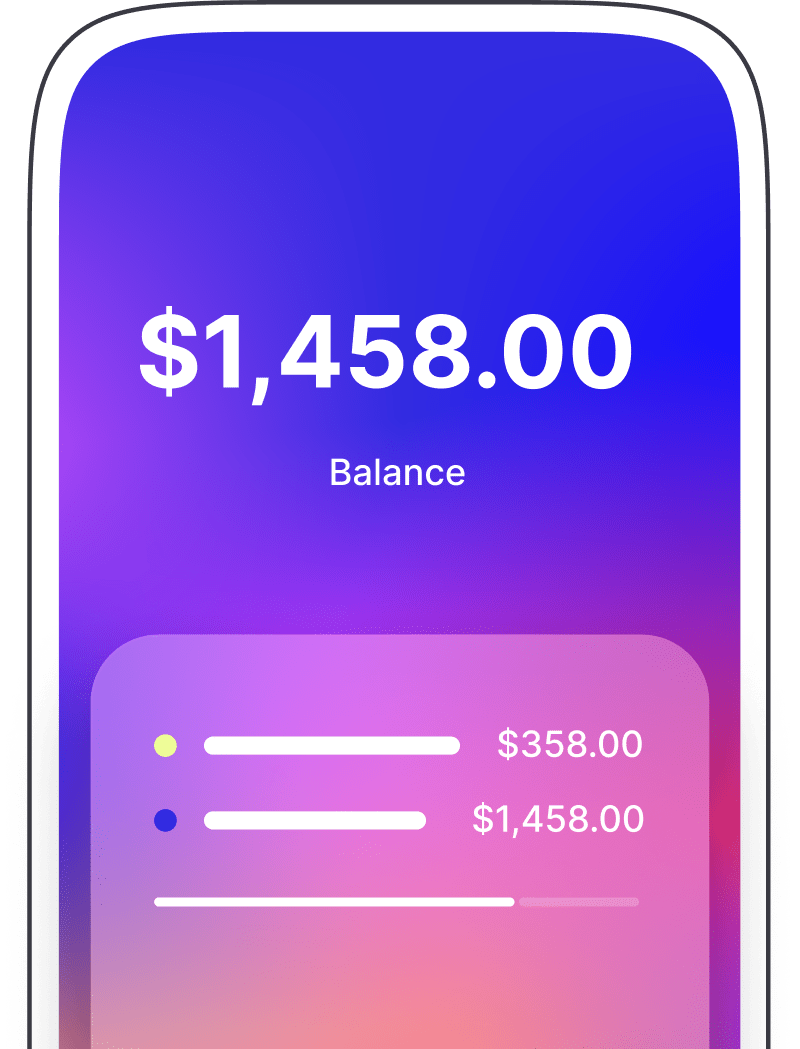

Unlock working capital through digital factoring. No interest. No compromise.

Fast. Digital. Financing.

Start your business growth journey with smart, accessible financing designed for SMEs. Our digital platform offers fast, transparent funding to help you unlock your cash flow and scale with confidence

Our Vision

“To become the leading global platform for ethical, Shariah-compliant business financing — empowering SMEs and entrepreneurs with fast access to capital through innovation and Islamic values.”

Helping Small Businesses Grow

Optima Limited provides fast and accessible business financing by converting your invoices into immediate cash flow. Fully digital, hassle-free, and designed to support your growth with fairness and transparency.

Transparent & Efficient

Submit invoices, get verified, and receive funding — all through our secure, user-friendly online platform.

Fully Digital

Submit invoices, get verified, and receive funding all through our secure online platform.

SME-Centric

Built specifically for small and medium-sized businesses needing fast, values-based financial support.

Finance That Aligns With Your Principles

Ethical by Design

We ensure full transparency by operating with clear, contract-based transactions built on accountability and trust — free from unnecessary complexity or hidden conditions.

Upfront Cash Flow

Turn your unpaid invoices into fast, upfront cash without loans or interest-based risk.

Transparent Process

No hidden fees, no complex contracts — just clear, simple digital financing for your business.

Real Business Backing

Every transaction is backed by genuine trade — not speculation, not leverage, just value.

Fast & Paperless

Our entire process is online. From signup to funding, we keep it secure, fast, and hassle-free.

Flexible for Growth

Whether you’re a startup or exporter, our solution scales with your needs — ethically and efficiently.

Upload. Approve.

Get Paid.

Submit your unpaid invoices and receive fast financing — all through one secure, paperless platform. No delays. No hidden fees. Just real-time access to the capital you’ve already earned.

Frequently Asked Questions

Explore quick answers to common questions about our digital invoice financing platform. Still curious? Get in touch — we’re here to help.

How does Optima Limited’s financing work?

We provide invoice-based financing through a streamlined, digital platform. You submit verified invoices, and we advance you a percentage of the value — giving you faster access to working capital without taking on traditional debt.

What kind of businesses can apply?

We work primarily with SMEs, exporters, and suppliers who issue B2B invoices. As long as your business complies with halal standards, we’ll work to support you.

How long does it take to get funded?

Once your invoice is verified, funds are typically disbursed within 1–3 business days. Our digital platform is designed to make this process as fast and smooth as possible.

What if my customer doesn’t pay on time?

There’s no penalty to you. Once funded, the responsibility shifts to us — we manage the follow-up with your customer professionally, so you can focus on running your business.